|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|||||||

|

|

|

|||||||

|

|

||

|

||

|

© 2022 Management Recruiters International, Inc. Each office is individually owned and operated. An equal opportunity employer. |

|

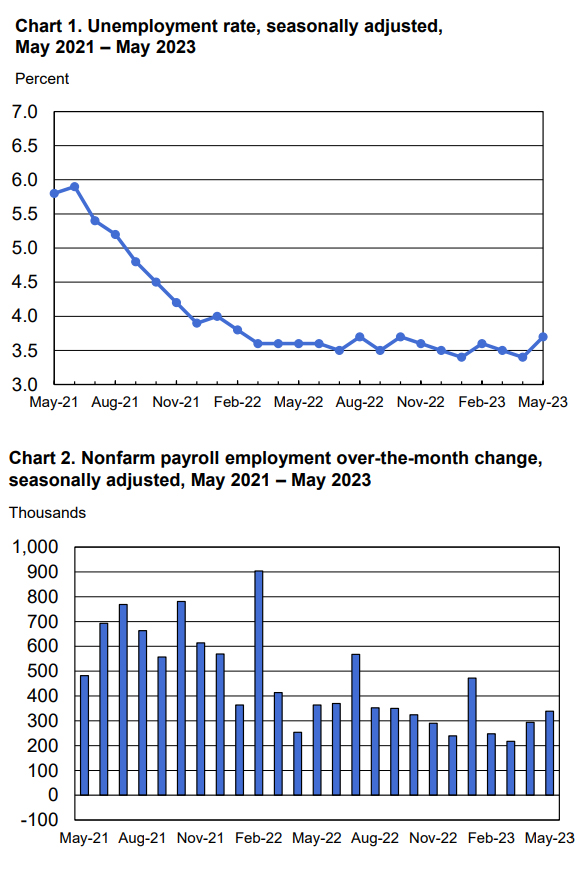

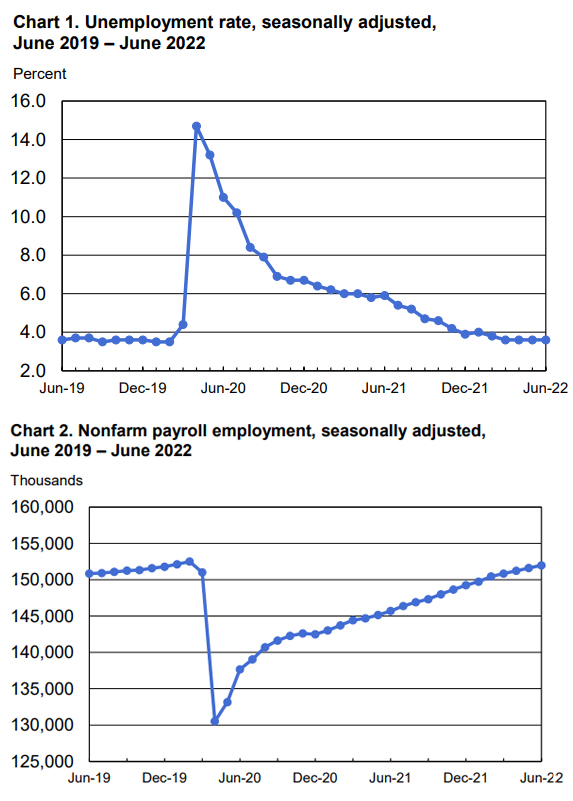

Employment Summary for June 2022

June’s employment report from The U.S. Bureau of Labor Statistics (BLS) provided some insight into the direction of the economy into the second half of 2022. The BLS reported a gain of 372,000 non-farm jobs, solidly above analysts’ expectations.

Unemployment remained unchanged for the fourth month in a row, at 3.6 percent. Unemployment among the college-educated civilian workforce, the primary target of the MRINetwork’s recruitment efforts, remained at a near record low inching up 0.1 percent to of 2.1 percent.

Employed persons who reported some teleworking during the month continued to decline, now at 7.1 percent. This is well below the peak recorded during the Covid outbreak, indicating a gradual return to traditional at-work behaviors.

“In spite of growing economic headwinds, today’s BLS survey continues to indicate that top management, executive, professional and managerial talent remain in demand as smart firms look beyond the short-term business horizon to ensure they are focused on deploying the best talent in every high-value key decision position.

The best leaders and companies recognize opportunity and remain laser focused on building organizations. They are focused on building their culture, value, and purpose to create a work environment that embodies a true destination for talented performers. As importantly, our teams guide top candidates to conduct informed due diligence to ensure that they drill down during the interview process to go beyond merely confirming the firm’s reputation but to aligning that reputation with their career goals,” said Bert Miller, President and CEO of MRI, one of the world’s leading search and recruitment organizations.

Jonathan Golub, Chief U.S. Equity Strategist at Credit Suisse in New York noted, "It’s very, very difficult to get a recession with so many job openings. In reality, a recession, more than anything else, is a collapse in the labor market, a spike in the unemployment rate, and right now, we’re not seeing anything that looks like that at all."

Adding context to today’s BLS report, Aditya Bhave, Senior U.S. and Global Economist at Bank of America observed, “Overall, we’re looking at a very solid jobs report. I think there’s been some concerns about a slowdown in consumer spending and the housing sector, but that’s not showing up yet in the labor market.”

Total nonfarm payroll employment gains were in line with the average monthly increases over the prior 3 months (+383,000). In June, notable job growth occurred in professional and business services, leisure and hospitality, and healthcare.

Employment in professional and business services continued to grow, with an increase of 74,000 in June. Within the industry, job growth occurred in management of companies and enterprises (+12,000), computer systems design and related services (+10,000), and office administrative services (+8,000).

In June, leisure and hospitality added 67,000 jobs, as growth continued in food services and drinking places (+41,000).

Employment in health care rose by 57,000 in June, including gains in ambulatory health care services (+28,000), hospitals (+21,000), and nursing and residential care facilities (+8,000).

In June, transportation and warehousing added 36,000 jobs. Employment rose in warehousing and storage (+18,000) and air transportation (+8,000).

Employment in manufacturing increased by 29,000 in June and has returned to its February 2020 level.

Information added 25,000 jobs in June and is now 105,000 higher than in the pre-pandemic period.

Employment showed little change over the month in other major industries, including construction, retail trade, financial activities, and other services.

“As we enter what looks to be a new business cycle, challenge yourself as a business leader. Are you looking for growth despite the obstacles presented by today’s market? Proactive leaders are prioritizing investments in hiring and retaining talent, they are investing in digital transformation initiatives, and they hold a belief in tomorrow which demands focused determination today,” noted Miller.

- The full Bureau of Labor Statistics report can be downloaded here:

|

|

|||||||

|

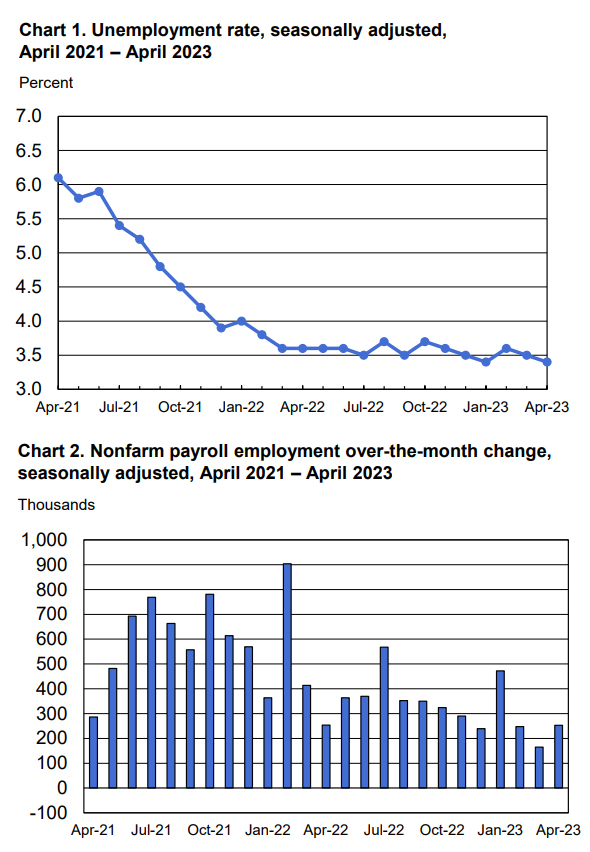

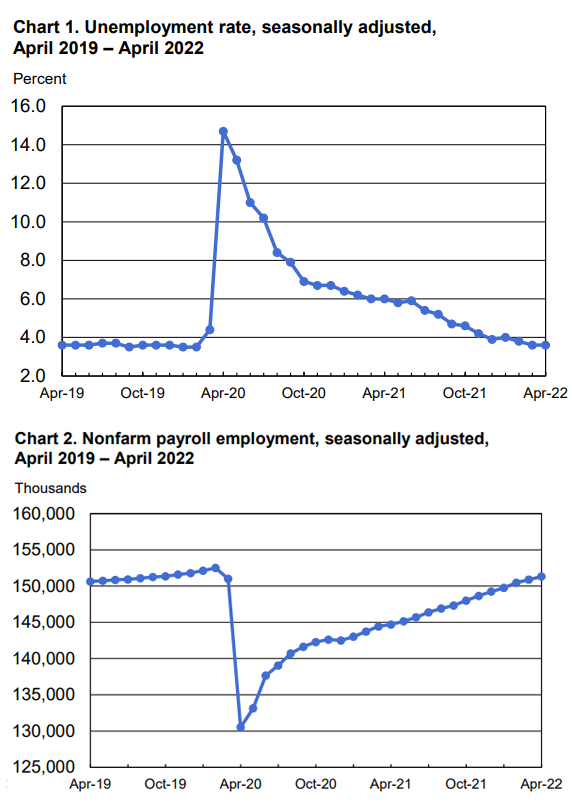

Employment Summary for April 2022

Despite rising interest rates, fears of an economic slowdown, and geopolitical turmoil, the U.S. Bureau of Labor Statistics (BLS) reported the economy added 428,000 jobs in April.

Unemployment remained unchanged at 3.6 percent. Among the college-educated civilian workforce, the primary target of the MRINetwork’s recruitment efforts, the unemployment rate remained at 2.0 percent pointing to a continued constrained labor market.

The number of job openings rose to 11.5 million by the end of March — indicating there are close to two open jobs for every unemployed person.

The number of employed persons reporting they had worked remotely at some point in March declined again to 7.7 percent as COVID-19 restrictions were lifted throughout the country and changes in employer policies increased on-site activity.

“Over 420 of our MRINetwork’s best recruitment professionals and talent advisors will meet in Fort Worth, Texas next week. With a theme of ‘Build-Learn-Connect-Engage,’ we will deliver incredible usable content in a unique learning environment to amplify and elevate our recruitment and talent consulting skillsets.

I mention this in context of today’s BLS Employment Situation Report to make a point. Regardless of any single data report, like today’s April employment growth of over 400,000 jobs, both growing talent-hungry firms and talented executive, technical, managerial and professional performers need to focus on building teams and leadership skillsets to drive future growth,” said Bert Miller, President, and CEO of MRI, one of the world’s leading search and recruitment organizations.

“A critical component of building organizations and individual careers is overcoming self-limiting fears. I have seen smart managers seemingly hit a ceiling once they have achieved a significant milestone like a successful product launch or earning a big promotion. At this point many allow a self-limiting mindset to hold themselves back and leave much future capacity and capability on the table.

Challenge yourself and your organization to constantly dream big. Peel back any fear or self-limiting mindset and don’t get comfortable with today’s success while pressing forward to take on the next goal.”

Mark Zandi, chief economist at Moody’s Analytics, provided a longer-term view of this month’s results, “The labor market continues to barrel along. We need it, at this point in time, to slow down a bit because we’re going to blow past full employment and inflation is going to become a bigger problem than it already is. Ultimately, we need to get to something that’s closer to no more than 100,000 a month.”

Noting that this is the 12th straight month of job gains above 400,000, though easing from a February gain of 750,000 jobs, Wall Street Journal reporter Josh Mitchell commented, “The labor market’s latest issue has been on the supply side, with an unusually tight pool of workers available to fill jobs, a dynamic that has fueled record wage growth and put pressure on rising inflation. In March there were just under six million unemployed people seeking work.” In the same article Kathy Bostjancic, chief U.S. economist at Oxford Economics added, “Anecdotally companies are still saying the biggest issue is a lack of available workers.”

Job gains in April were broad-based with moderate increases in most segments.

Employment in leisure and hospitality increased by 78,000 in April. Job growth continued in food services and drinking places (+44,000) and accommodation (+22,000).

Manufacturing added 55,000 jobs in April. Employment in durable goods rose by 31,000, with gains in transportation equipment (+14,000) and machinery (+7,000). This sector has recovered virtually all jobs lost since February 2020.

Employment in transportation and warehousing rose by 52,000 in April. Within the industry, job gains occurred in warehousing and storage (+17,000), couriers and messengers (+15,000), truck transportation (+13,000), and air transportation (+4,000). Employment in transportation and warehousing is 674,000 above its February 2020 level, led by strong growth in warehousing and storage (+467,000) and in couriers and messengers (+259,000).

In April, employment in professional and business services continued to trend up (+41,000). Since February 2020, employment in the industry is up by 738,000.

Financial activities added 35,000 jobs in April, led by a gain in insurance carriers and related activities (+20,000).

In other sectors, healthcare employment rose by 34,000 in April, employment in retail trade increased by 29,000, wholesale trade employment rose by 22,000, and mining added 9,000 jobs.

“Talented performers open their eyes wider than they thought possible — remove any blinders and seek a view that seems far away and yet, is within reach.

They are curious and intentional about learning and recognize where obtaining new skills and up-skilling will provide a clear career advantage.

None of us are what we can become. Eyes open and keep looking and working to see who you can become — you might just find yourself in place that you had never dreamed,” noted Miller.

- The full Bureau of Labor Statistics report can be downloaded here:

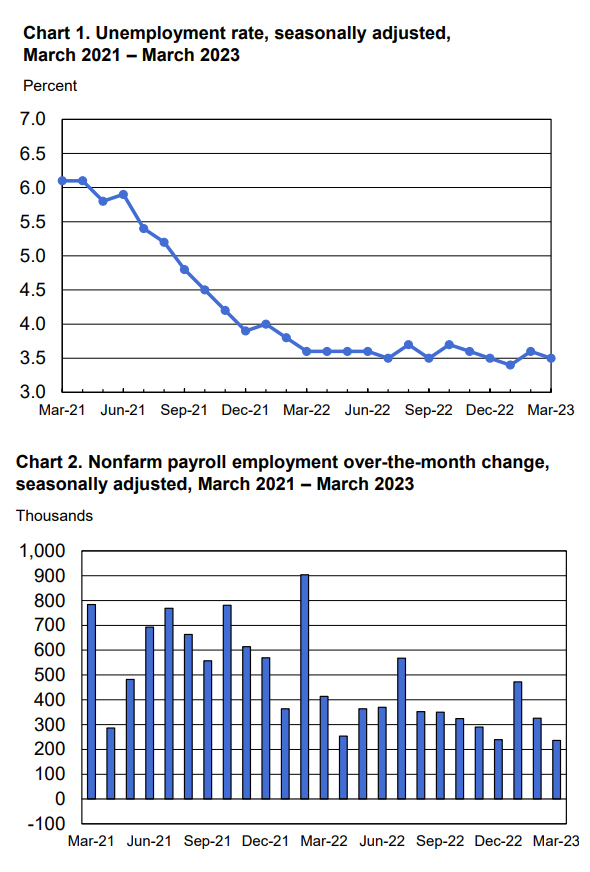

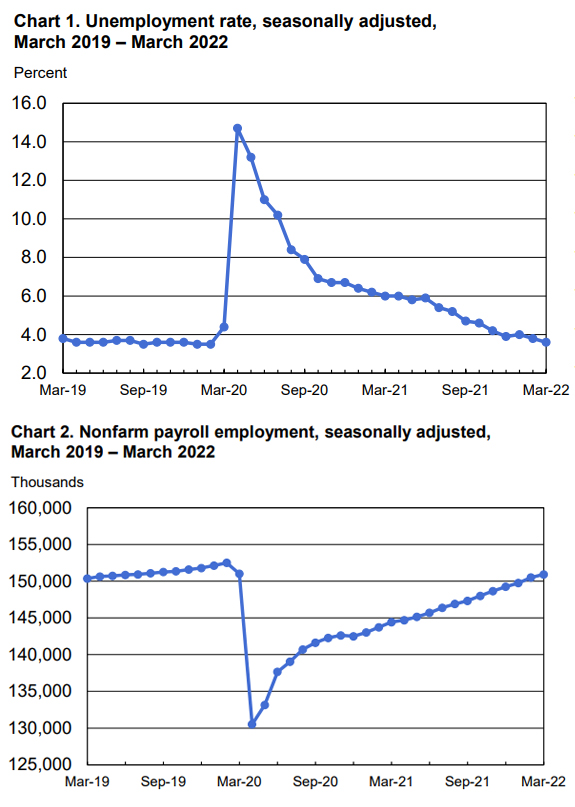

Employment Summary for March 2022

Meeting analysts’ expectations, the U.S. Bureau of Labor Statistics (BLS) reported the economy added 431,000 jobs in March. Unemployment continued to decline, now reported at 3.6 percent. Among the college-educated civilian workforce the unemployment rate was 2.0 percent indicating a continued tight labor market. The labor-force participation rate among the college-educated cohort rose to 72.8 percent. Today’s Wall Street Journal noted that household savings are declining, which is likely pressuring some individuals to rejoin the labor force to collect a paycheck, especially as prices rise briskly for gasoline, groceries and rent, perhaps adding to the full employment picture.

Teleworking declined again in March to 10.0 percent versus 13.0 percent in February as easing COVID-19 restrictions and changes in employer policies brought more people back to the workplace.

“The March BLS employment growth report comes as no surprise to our Network of over 1500 executive recruiters in offices throughout the U.S. Despite economic headwinds, the specter of growing inflation and geopolitical uncertainty we continue to see robust demand for talent in our clients’ organizations in every sector of the economy,” said Bert Miller, President, and CEO of MRI one of the world’s leading search and recruitment organizations.

“I have been immersed in the world of talent for 37 years; ten in corporate America and the last 27 in recruiting. Through recessions, periods of slow steady growth, and in rapid expansion cycles there has been one reoccurring challenge to talented performers in even top organizations. Individuals tend to get ‘comfortable’ — they stop intentional learning.

We coach talented executives, managers, professionals, and even technical-based workers to look past current economic conditions and to avoid complacency — to keep their eyes open to who they can become. Complacency in any position leads to mediocrity and mediocrity leads to missed business opportunities and to fewer career options.

Our advice is simple. Be intentional, disciplined and never lose that curiosity to learn. Find who you can be without limitations. Top talent, at any career level, knows they could get that promotion, work with a dream organization, or even run a company.”

“All the constraints on the labor supply that were prevailing in 2021 have really eased,” said Lydia Boussour, economist at Oxford Economics. That is “a really important factor in driving that next leg of the recovery and getting employment back to where it was before the pandemic.”

Commenting on the overall health of the employment market despite the headwinds, Jefferies Group analysts Aneta Markowska and Thomas Simons noted, "It’s premature to start the recession countdown. This does not look like a late-cycle economy … It’s a mid-cycle economy and the business cycle has room to run."

Employment in leisure and hospitality continued to increase, with a gain of 112,000 in March. Job growth occurred in food services and drinking places (+61,000) and accommodation (+25,000). Employment in leisure and hospitality continues to recover from its steep decline and is now down by only 8.7 percent, since February 2020.

Job growth continued in professional and business services, which added 102,000 jobs in March. Employment in this sector is now 723,000 higher than in February 2020.

Employment in retail trade increased by 49,000 in March, with gains in general merchandise stores (+20,000) and food and beverage stores (+18,000).

Manufacturing added 38,000 jobs in March. Employment in durable goods industries rose by 22,000. Nondurable goods manufacturing added 16,000 jobs over the month, including a gain in chemicals (+7,000).

Employment in construction continued to trend up in March (+19,000). Also in March, employment in financial activities rose by 16,000, with gains in real estate and rental and leasing (+14,000). Employment in both of these industry segments is now at or above pre-pandemic levels.

Employment in healthcare and in transportation and warehousing was essentially unchanged in March following large gains in these sectors in the prior 2 months.

“Talented performers open their eyes wider than they thought possible — remove any blinders and seek a view that seems far away and yet, is within reach.

They are curious and intentional about learning and recognize where obtaining new skills and up-skilling will provide a clear career advantage.

None of us are what we can become. Eyes open and keep looking and working to see who you can become — you might just find yourself in place that you had never dreamed,” noted Miller.

- The full Bureau of Labor Statistics report can be downloaded here:

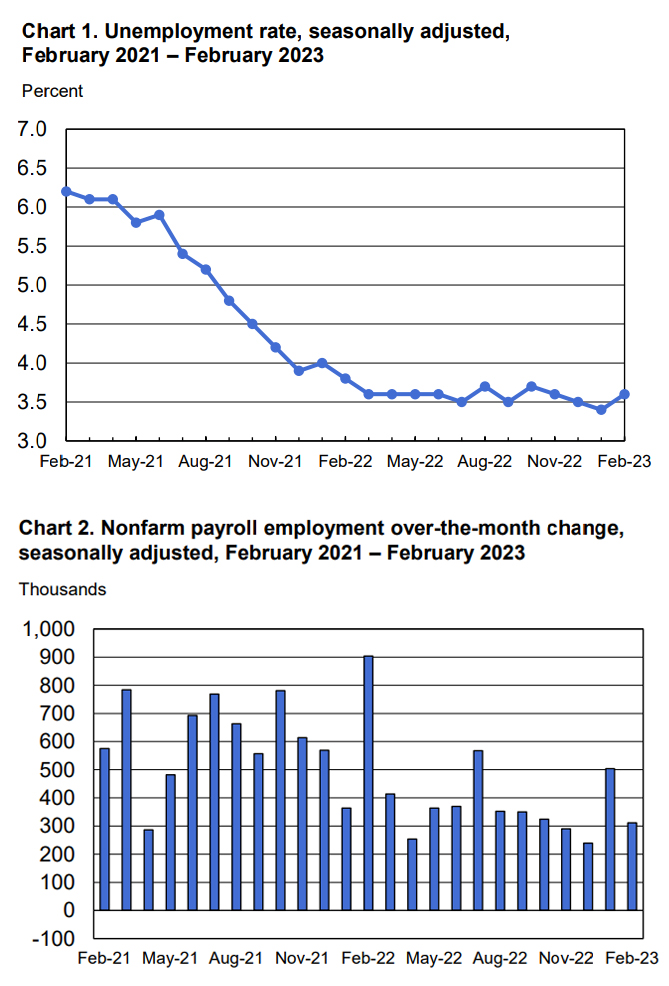

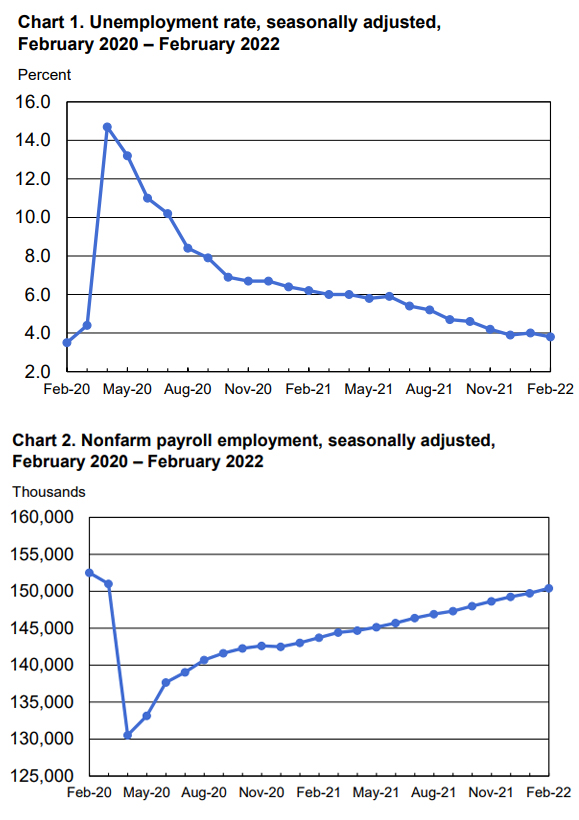

Employment Summary for February 2022

The U.S. Bureau of Labor Statistics (BLS) reported the economy added a robust 678,000 jobs in February as the unemployment rate edged down to 3.8 percent. Job growth was widespread, with notable gains in leisure and hospitality, professional and business services, healthcare, and construction. Among college-educated civilian workers, the unemployment rate declined slightly to 2.2% — near record lows.

Teleworking declined in February from January’s high of 15.4 percent to 13.0 percent as the labor force responded to easing COVID-19 restrictions.

“February’s BLS report continues to chart an ongoing jobs recovery since March 2020. More importantly it measures growth in skilled jobs as unemployment among college educated workers points to virtually full employment. The Chicago Fed’s February Letter has an interesting analysis that aligns with many of our executive recruitment team’s observations about the new world of work emerging as the COVID-19 threat fades and the economy continues to grow. Essentially the report concludes that millions of skilled workers quickly took the first job available in the months following the March 2020 COVID-19 plunge. Many of those new positions did not align with the job seekers skills, purpose nor did they find a compelling cultural match. These people as well as the thousands of executive, technical, professional, and managerial workers who were not impacted by layoffs see this recovery period as an opportunity to make a positive career change,” said Bert Miller, President and CEO of MRI.

“Some talent industry analysts have asked, ‘why is so much of the workforce unhappy?’ as if unhappiness was driving much of this job churn. Based on what our Network of over 1500 professional recruiters observes and what I see in the market, it is not unhappiness. It is a workforce that is not finding career fulfillment.

We spend a great deal of time at work. In many ways, our job defines what we are, how secure we feel, and to a certain extent, if we’re able to actualize our dreams. When you’re stuck in a job with no advancement potential, little stability, and earnings that don’t reflect what you’re worth, it’s not a good place to be. When those priorities are met, people are more fulfilled.

It really comes down to building an attractive workplace culture through values — focusing on the things that are important to the top performers. We counsel our clients to focus on a strong hiring and individual brand, culture and core values.”

Jay Timmons, president and CEO of the National Association of Manufacturing noted a key factor in providing workers with a sense of fulfillment is a push to provide paths to ‘upskilling.’ "There’s hardly ever been more opportunities for future manufacturing workers. Innovators. Designers. Technicians. Creators," he commented. "To help workers advance in their careers, companies are investing in upskilling programs — so that people can keep improving their skills as technology advances throughout their careers.”

Wall Street Journal reporter Josh Mitchell provided context to the need for employers to create a more attractive workplace, “While virus infections have fallen sharply since their peak in mid-January, employers say they continue to struggle to find workers as they respond to a high level of spending from households. Though some workers have come off the sidelines in recent months, the labor force remains depleted, with many older workers having retired, immigration down sharply and some younger and middle-aged workers remaining at home.”

Employment in leisure and hospitality continued to increase, with a gain of 179,000 in February. Job growth occurred in food services and drinking places (+124,000) and in accommodation (+28,000). While continuing a robust trend in job creation, employment in this sector remains 1.5 million lower than in February 2020.

Professional and business services added 95,000 jobs in February, with job gains in virtually every sector including management of companies and enterprises (+12,000) and management and technical consulting services (+10,000). Employment in professional and business services is 596,000 higher than in February 2020.

Employment in healthcare rose by 64,000 and in construction by 60,000 in February.

Transportation and warehousing employment increased by 48,000 in February and is 584,000 higher than in February 2020.

In other industries, February employment rose by 37,000 in retail trade, 36,000 in manufacturing, and 35,000 in financial activities.

“People gravitate towards values-focused organizations, firms that offer flexibility, with leaders and team members who they enjoy working with every day. Talented workers want to work with firms that have compelling clearly stated purpose and values, enlightened leadership and yes, competitive compensation. These factors drive not only loyalty, but they also create an environment that drives true career fulfillment,” noted Miller.

- The full Bureau of Labor Statistics report can be downloaded here:

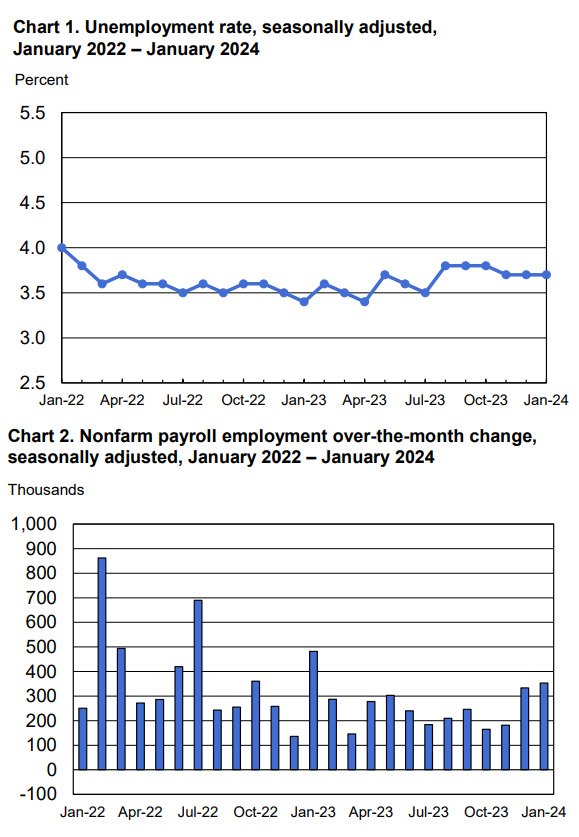

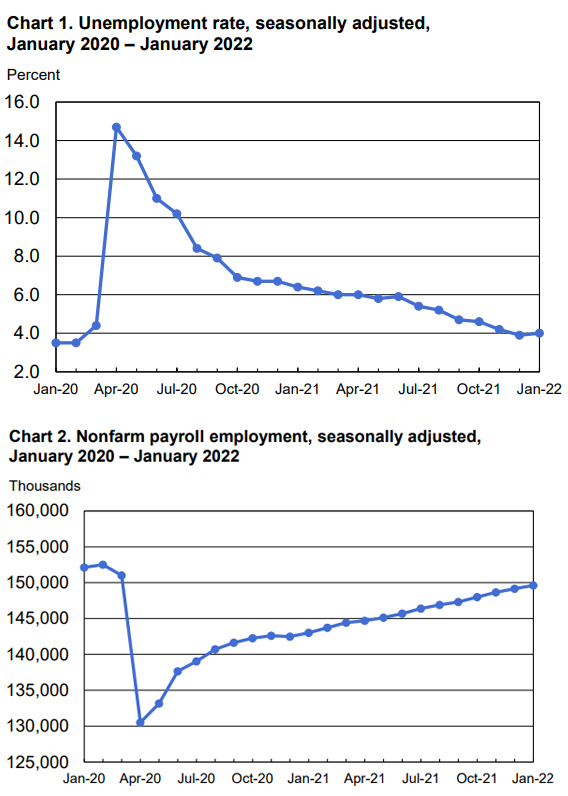

Employment Summary for January 2022

Total non-farm payroll employment rose by 467,00 in January, well above analyst’s estimates that had factored in a significant impact for the COVID-19 Omicron variant. Today’s U.S. Bureau of Labor Statistics (BLS) report also noted the unemployment rate edged higher to 4.0 percent. The unemployment rate for college-educated members of the civilian workforce increased slightly to 2.3 percent but still at a level indicating near full employment in this demographic.

Notable job gains occurred in multiple sectors, with the highest increase in leisure and hospitality.

The labor force participation rate data increased slightly to 62.2 percent but remained below the pre-pandemic level of 63.4 percent.

The percent of non-farm workers reporting that they teleworked at some point in the past four weeks jumped to 15.4 percent versus 11.1 percent in December 2021. The increase might be due to short-term effects of the jump in Omicron infections throughout January.

“January’s BLS report tells a short-term story about the effects of the Omicron surge as an estimated 9 million workers called in sick in early January and employee work-from-home rates increased. These factors clouded the jobs data forecasts. In our most recently reported month, December 2021, our MRINetwork of over 300 search firms and more than 1,500 recruitment professionals saw through the clouds. Network revenue from search assignments increased 25% versus the previous December. Our view is underlying demand for executive, technical, professional and managerial talent remains strong,” said Bert Miller, President and CEO of MRI. “I’ve been in the executive recruitment business for over 27 years and have seen economic cycles drive peaks and valleys in hiring demand. What I haven’t seen is top performing firms easing up on the hiring throttle as they continue to build best-in-class leadership, sales, marketing, and operations teams. Talented individuals are in demand today and will continue to be in demand through virtually any business cycle. That’s why we continue to help our clients to build and effectively communicate their hiring brand, culture, and core values to attract the best talent.”

Wall Street Journal reporters Sarah Chaney Cambon and Gabriel T. Rubin observed, “Many workers are reaping their largest pay gains in years, as companies compete for a limited pool of workers. Wage growth — at nearly 5% — is much stronger than the average of about 3% before the pandemic hit. They also quoted Luke Tilley’s, chief economist at Wilmington Trust Investment Advisors, observation that ‘The labor market is as tight as we have ever seen it.’

Goldman Sachs economist Spencer Hill noted that people who reported they couldn’t work because their employer closed or lost business due to the surge were likely offset by fewer-than-normal year-end layoffs as many companies were hesitant to let workers go amid widespread labor shortages.

Employment in leisure and hospitality expanded by 151,000 in January, reflecting job gains in food services and drinking places (+108,000) and in the accommodation industry (+23,000). This industry was among the hardest hit since the onset of the virus. Employment in leisure and hospitality is down by 1.8 million, or 10.3 percent since February 2020.

In January, professional and business services added 86,000 jobs across multiple segments. Job gains occurred in management and technical consulting services (+16,000), computer systems design and related services (+15,000), architectural and engineering services (+8,000), and other professional and technical services (+7,000). Employment in this industry is 511,000 higher than in February 2020.

Retail trade employment rose by 61,000 in January. Most of the job growth occurred in general merchandise stores (+29,000); health and personal care stores (+11,000).

Employment in transportation and warehousing increased by 54,000 in January and is 542,000 higher than in February 2020. In January, job gains occurred in couriers and messengers (+21,000), warehousing and storage (+13,000), truck transportation (+8,000), and air transportation (+7,000).

Employment in healthcare and wholesale trade continued to trend up +18,000 and + 16,000 respectively. Employment showed little change over the month in mining, construction, manufacturing, information, financial activities, and other services.

“At our recent MRINetwork leadership conference I repeated Nelson Mandela’s sage advice, ‘There is no passion to be found playing small — in settling for a life that is less than the one you are capable of living.’ Our advice to talented professionals both starting their careers and with decades of experience reflects that sentiment. The key factor differentiating why some candidates go on to run companies and live the life they want personally, professionally, and financially is overcoming self-limitation. Individuals have more control over their careers today than perhaps ever. We urge people to think big — think infinite and to be courageous enough to maximize and live the life you are capable.

“It’s clear from my vantage point that those who never limit themselves or play small are the people today’s leading companies will target. My best advice for any manager or professional … Do not play small and Do not settle. If you do, you will limit yourself and be less than you are capable. Think big, be humble, tirelessly work on your game and be courageous,” noted Miller.

- The full Bureau of Labor Statistics report can be downloaded here:

© 2022 Management Recruiters International, Inc.

Each office is individually owned and operated. An equal opportunity employer.

If you would no longer like to receive e-mails, simply reply to this email with "Opt Out" in the subject.

|

|

|||||||

|

|

|

|||||||

|

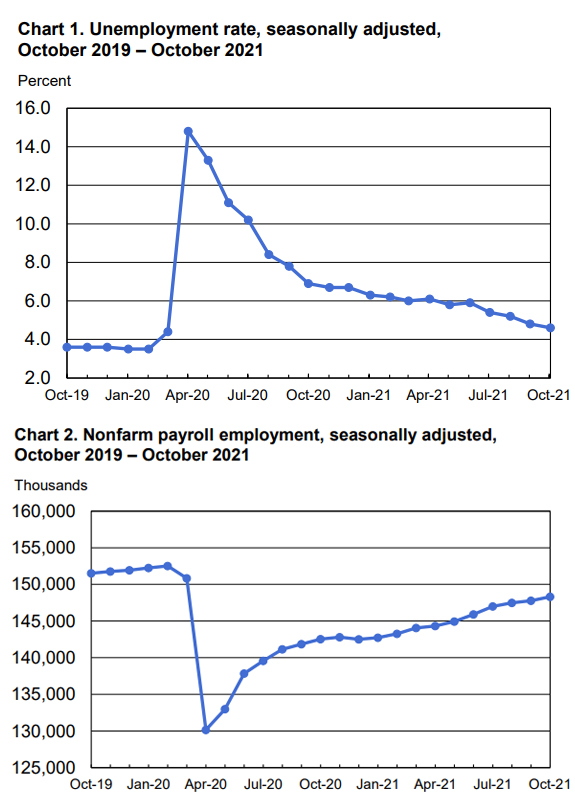

Employment Summary for October 2021

There are tangible signs that the economy is emerging from a delta virus-induced slowdown reflected in improved consumer confidence scores, increased October new homes sales, continued declines in initial unemployment claims and in today’s U.S. Bureau of Labor Statistics (BLS) survey. Employment growth in October of 531,000 indicated a solid gain, above analysts’ expectations but still below the higher pace from earlier this year. Job growth was recorded throughout the report with particular gains in leisure and hospitality, professional and business services, manufacturing and transportation, and warehousing.

The unemployment rate declined by 0.2 percentage point to 4.6 percent.

The percent of nonfarm workers reporting that they teleworked at some point in the past four weeks decreased significantly to 11.6 percent versus 13.2 percent in the prior-month and from the 13 plus percent range for the past several months. This could be a one-month aberration, or it might indicate an acceleration in rate of return to on-site work.

“Our MRINetwork leaders in over 300 search firms pay close attention to the month-to-month trends in the BLS data. This month once again we see continued job creation. But each month I caution our team to ensure that their clients don’t take a short-term reactive hiring approach based on a current supply-demand snapshot. Our most successful clients have a clear understanding of the need to be constantly attracting top talent, to have a 12-to-18-month hiring perspective. Those who hire with a short-term lens, focused on next the quarter’s profitability will find it daunting to attract the best talent,” said Bert Miller, President and CEO of MRI.

“Great companies are looking at their talent needs beyond the range that served them well in earlier economies. These firms not only look beyond a short-term horizon, but they also clearly know why they do what they do, they have a defined culture, and more importantly they have a deep commitment to a set of core values. These firms provide resources to nurture their team’s skills growth as they consistently market to the best talent. Not too surprisingly they see by-product benefit reflected in revenue and profit growth.”

Bank of America U.S. economist Alex Lin reflecting on recent delta impacts noted, “We think a big constraint or headwind causing some of the slowdown we’ve seen in recent months was COVID-related, and now it seems the cases and hospitalizations are trending in the right direction.” He expected restaurants, hotels, and retailers to be among the businesses adding workers in big numbers.

Wall Street Journal reporter Josh Mitchell added insight into this month’s BLS data, “The report suggests the labor market and economy is picking back up after the recovery fell into a summer rut because of the Delta variant. Delta cases declined. Employers desperate to hire to meet strong demand from consumers are rapidly raising wages, dangling bonuses and offering more flexible hours. And households are spending down a big pile of savings that had been boosted by federal stimulus money and extra unemployment benefits. Even with last month’s pickup, job growth remained below the monthly average of 641,000 jobs that the economy created in the first seven months of the year.”

Employment in leisure and hospitality increased by 164,000 in October and has risen by 2.4 million thus far in 2021. Over the month, employment rose by 119,000 in food services and drinking places and by 23,000 in accommodation.

Professional and business services added 100,000 jobs in October, including a gain of 41,000 in temporary help services. Employment continued to rise in management and technical consulting services (+14,000), other professional and technical services (+9,000), scientific research and development services (+6,000).

Employment in manufacturing increased by 60,000 in October, led by a gain in motor vehicles and parts (+28,000). Employment also rose in fabricated metal products (+6,000), chemicals (+6,000), as well as printing and related support activities (+4,000).

Employment in transportation and warehousing increased by 54,000 in October and is 149,000 above its February 2020 level. In October, job gains occurred in warehousing and storage (+20,000), transit and ground passenger transportation (+16,000), air transportation (+9,000), and truck transportation (+8,000). Employment in couriers and messengers decreased by 5,000 in October, after increasing in the prior 3 months.

Solid growth was seen across a broad range of other non-governmental sectors. In October employment in the construction industry increased by 44,000 and job gains were noted in healthcare, retail trade, “other services,” financial, and wholesale trade. Employment in information changed little in October.

“The labor market remains tight in the executive, professional, managerial and technical arena that is our Network’s core focus. In our most recently reported month, September 2021, our same-office billings increased almost 75% versus the prior-year period. On a year-to-date basis every industry practice has grown significantly versus the same period in 2020. Exceptional growth was seen in Healthcare, Financial, and the Professional Services industries. Talent remains tight in both permanent positions and increasingly in work-from-anywhere arrangements or contract placement positions. Firms throughout the economy should anticipate continued pressure in finding, hiring, and on-boarding the best and brightest performers. The shift in the world of work over the next few years will leave firms competing for skilled workers like never before,” said Miller.

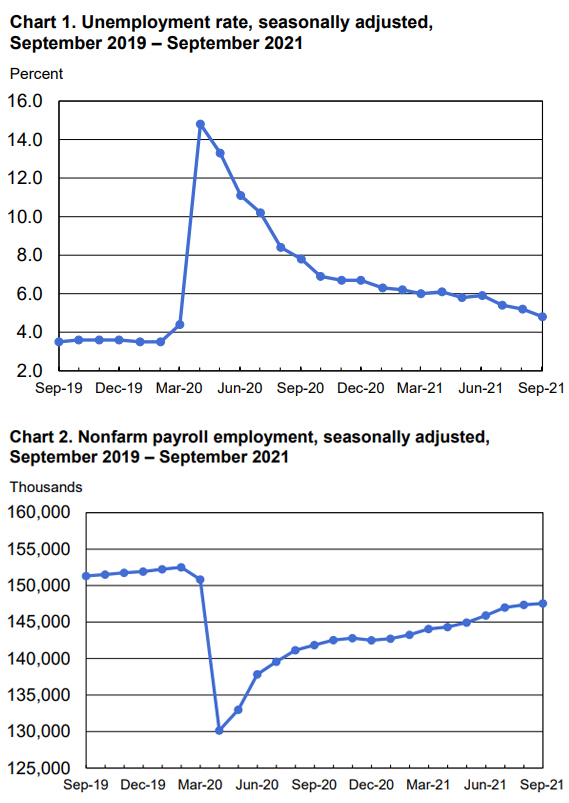

Employment Summary for September 2021

Employment growth in September fell well below consensus estimates with the addition of 194,000 jobs as reported in today’s U.S. Bureau of Labor Statistics (BLS) survey. Job growth, while moderate overall, was positive across most of the key industries measured by the BLS with notable growth in leisure and hospitality and in professional and business services. The unemployment rate declined by 0.4 percentage point to 4.8 percent.

The percent of nonfarm workers reporting that they teleworked at some point in the past four weeks because of the pandemic was 13.2 percent, little changed from the prior three months. This might indicate a new level of “normal” for work-from-home rates.

“Each month talent advisors in our global MRINetwork of 300 search firms look to the BLS analysis for insights into current hiring demand data for skilled executive, professional, technical, and managerial workers. Once again, this month, though not as robust, the demand for talent remains with the arrow pointed north,” said Bert Miller, President and CEO of MRI. “We consult every client to not just react to today’s demand for transformative talent but to look further downrange to ensure they not only understand ‘why’ they are doing well today but to understand ‘how’ they must change their organization over time to ensure healthy sustainability. We ask them to go beyond thinking their business is healthy since there is wind behind their sails and their industry is growing as well. We caution that the cumulative effects of standing still with a status quo viewpoint will at some point, potentially have a negative impact. The message is simple, do not sit still — move forward — innovate or you could be moving backwards. High water hides submerged obstacles. It is essential to have the right talent on your team who recognize where the business is headed and can drive the often-small cumulative changes that will separate their firm from the pack over a sustained period time.”

Wall Street Journal reporter Josh Mitchell summarized the overall jobs report succinctly, “The figures add to evidence that fears about the virus and global supply constraints continue to hold back the economic recovery. The biggest factor behind last month’s weak payroll gain was a decline in public-sector jobs, mainly at schools. Employment in private-sector industries rose by 317,000 in September, with modest gains across several industries. The spread this summer of the Delta variant, a particularly contagious strain of COVID-19, likely spooked would-be job seekers and impeded speedier job growth in September, despite many companies being desperate to hire, economists and business leaders say.”

Adding context to today’s BLS data, Seema Shah, chief strategist at Principal Global Investors noted, “After looking like almost a done deal, today’s jobs number has thrown expectations for (Federal Reserve) tapering into disarray. The Fed doesn’t seem to need much to convince it that tapering should begin imminently, but at just 194,000, jobs numbers are suggesting that the labor market is further from hitting the substantial progress goal than they expected.”

Employment in leisure and hospitality increased by 74,000 in September, with continued job growth in arts, entertainment, and recreation (+43,000). Employment in food services and drinking places changed little for the second consecutive month.

Professional and business services added 60,000 jobs in September. Employment continued to increase in architectural and engineering services (+15,000), management and technical consulting services (+15,000), and computer systems design and related services (+9,000).

In September, employment in retail trade rose by 56,000, following 2 months of little change. Over the month, employment gains occurred in clothing and clothing accessories stores (+27,000), general merchandise stores (+16,000), and building material and garden supply stores (+16,000). These gains were partially offset by a loss in food and beverage stores (-12,000).

Moderate growth was seen across a number of sectors. In September, employment in the information industry increased by 32,000, employment in manufacturing increased by 26,000, construction employment rose by 22,000, and wholesale trade jobs increased by 17,000.

In September, employment decreased by 144,000 in local government education and by 17,000 in state government education. Employment changed little in private education (-19,000).

“In our most recently reported month, August 2021, our same-office billings increased almost 70% versus the prior-year period. Additionally, on a year-to-date basis every industry practice has grown significantly versus the same period in 2020 with practices groups like Financial, Healthcare, and Professional Services exceeding 60% growth rates. Our consultants are also looking beyond legacy ‘analog’ talent solutions. Work from anywhere arrangements, or contract placements, now represent a significant factor in our portfolio services as our clients increasingly turning to interim work arrangements to source critical talent,” said Miller.

- The full Bureau of Labor Statistics report can be downloaded here:

Employment Summary for August 2021

Robust growth in the leisure and hospitality industry faltered in August as the Delta variant put pressure on non-farm hiring. Despite that factor, the U.S. Bureau of Labor Statistics (BLS) reported an increase in total nonfarm payroll employment of 235,000 jobs. Results were below analyst expectations but in line with some forecasts that had recognized the potential slowdown in leisure and hospitality hiring. The unemployment rate declined by 0.2 percentage point to 5.2 percent.

The percent of nonfarm workers reporting that they teleworked at some point in the past four weeks because of the of the pandemic was little changed from the prior month. In August, 13.4 percent of employed persons reported teleworking, perhaps indicating a new base of the level of work-from-home behavior.

“Demand for talent, particularly transformative talent, continues to drive revenue and placement growth in our global Network of 300 executive search offices. Our consultants recruit top executive, technical, managerial, and professional talent for clients in virtually every industry sector. In our most recently reported month, July 2021, our offices successfully completed almost 50 percent more search assignments versus the same period last year,” said Bert Miller, President and CEO of MRI. “We saw strength in every industry practice area with particular strength in the professional services and financial industry sectors. However, client demand for talent is not only focused on ‘permanent’ positions. Flexible work arrangements, or contract placements, represent a significant factor in our talent solution services. More companies now realize they can get critical work done through both interim and full-time work arrangements.”

As reported by Fox Business, “The variant may have discouraged some Americans from flying, shopping and eating out. Americans have been buying fewer plane tickets and reducing hotel stays. Restaurant dining, after having fully recovered in late June, has declined to about 10% below pre-pandemic levels.”

Additional context to today’s BLS numbers were provided by David Berson, chief economist at Nationwide Mutual Insurance Co. “Despite the Delta variant, there is still an opening up of the service sector of the U.S. economy. While that started some months ago, it’s not nearly complete.”

Employment in professional and business services increased by 74,000 in August. Employment rose in architectural and engineering services (+19,000), computer systems design and related services (+10,000), scientific research and development services (+7,000), and office administrative services (+6,000).

Transportation and warehousing added 53,000 jobs in August, bringing employment in the industry slightly above (+22,000) its pre-pandemic level in February 2020. Employment gains have been led by strong growth in couriers and messengers and in warehousing and storage, which added 20,000 jobs each in August.

Manufacturing added 37,000 jobs in August, with gains in motor vehicles and parts (+24,000) and fabricated metal products (+7,000).

In other sectors, “other services” industry added 37,000 jobs in August, employment in information increased by 17,000 and employment in financial activities rose by 16,000 over the month, with most of the gain occurring in real estate (+11,000).

Employment in retail trade declined by 29,000 in August, with losses in food and beverage stores (-23,000).

As noted above, in August, employment in leisure and hospitality was unchanged, after increasing by an average of 350,000 per month over the prior six months. In August, employment showed little change in other major industries, including construction, wholesale trade, and healthcare.

“Our Network of talent professionals are meeting client demand for top performers every day. A key message we convey to our clients is to focus on truly brilliant talent at every level of their organization. These performers can be characterized as ‘multipliers,’ the people on a team who can multiply their impact. They don’t wait to be given direction, rather they relish entering the fray immediately. They are high performers who can accomplish an above average work rate and bring others up alongside them. Identifying the attributes takes skill, but there are signs that top interviewers can spot during the hiring process. We help clients surround themselves with these players at every organizational level. In today’s rapidly evolving world of work, multipliers provide a competitive edge,” noted Miller.

Employment Summary for July 2021

For the seventh straight month, the U.S. Bureau of Labor Statistics (BLS) reported a significant increase in total nonfarm payroll employment. In July, jobs increased by 943,000. Results were above analyst expectations as continued wage growth fueled the rate of hiring. The unemployment rate declined by 0.5 percentage point to 5.4

Once again, gains in the leisure and hospitality industry drove much of the expansion as 380,000 new jobs were added with two-thirds of the total increase in food services and drinking places.

“Our global Network of over 300 executive search offices continue to see robust demand for executive, technical, managerial, and professional talent in every industry sector reflecting the powerful hiring demand reported in this month’s BLS employment data. In our most recently reported month, June 2021, our offices successfully completed 87 percent more search assignments versus the same prior-year period,” said Bert Miller, President and CEO of MRI. “Placement of talent in the professional services practice, which more than doubled, was our fastest growing segment, but we saw year-over-year growth exceeding 70% in all of our practice groups. We are guiding our clients to leverage this robust jobs market to select and hire talent with critical thinking skills — an attribute that will drive value throughout their entire enterprise.”

The percent of nonfarm workers reporting that they teleworked at some point in the past four weeks because of the of the pandemic declined for the third consecutive month. In July, 13.2 percent of employed persons reported teleworking, down from 14.4 percent in the prior month indicating continued acceleration in the rate of return to on-site work.

“This not only was a strong jobs report by nearly every measure, it also signals more good things to come,” said Robert Frick, corporate economist at Navy Federal Credit Union.

Reporter Eric Morath of The Wall Street Journal provided additional context to today’s BLS numbers. “So far, little evidence suggests that the recent (delta strain) case surge is significantly slowing the U.S. recovery — and the economy has built up a cushion from the availability of vaccines, business reopenings, pent-up consumer demand and aid flowing from multiple rounds of government stimulus legislation.”

In July, employment in leisure and hospitality increased by 380,000. With gains in food services and drinking places (+253,000). Employment also continued to increase in accommodation (+74,000) and in arts, entertainment, and recreation (+53,000).

Employment in July rose by 221,000 in local government education and by 40,000 in private education. Staffing fluctuations in education due to the pandemic have distorted the normal seasonal buildup and layoff patterns, likely contributing to the job gains in July.

Employment in professional and business services rose by 60,000 in July. Within the industry, employment in the professional and technical services component rose by 43,000 over the month and is 121,000 above its pre-pandemic February 2020 level.

Transportation and warehousing added 50,000 jobs in July. Job growth occurred in transit and ground passenger transportation (+19,000), warehousing and storage (+11,000), and couriers and messengers (+8,000). The industry has recovered 92.9 percent of the jobs lost since the onset of the pandemic.

Healthcare added 37,000 jobs in July. Job gains in ambulatory healthcare services (+32,000) and hospitals (+18,000) more than offset a loss of 13,000 jobs in nursing and residential care facilities.

Employment gains in most other sectors grew modestly or were little changed versus June. Employment in manufacturing increased by 27,000 in July, largely in durable goods manufacturing. Jobs in information increased by 24,000 over the month, Employment in financial activities rose by 22,000 over the month, largely in real estate and rental and leasing (+18,000). Employment in retail trade and construction changed little in July, following large increases in the prior two months.

“I see a U.S. economy creating an additional ‘net’ 12 million new jobs by 2025. Many of these roles will be different than today. More repetitive tasks will be performed by technology rather than people; thus employers will need more employees with strong technical skills across multiple disciplines.

Teams will ultimately focus on more value-generating tasks; technology can’t make decisions and solve problems in the same way as a talented performer. Critical thinking skills will be imperative for both teams and leaders,” noted Miller.

|

Employment Summary for June 2021 Continuing a six month increase in job growth, the U.S. Bureau of Labor Statistics (BLS) today reported total nonfarm payroll employment increased by 850,000. Results were above analyst expectations as higher wages and incentives to meet growing demand drew more workers back into the labor force. Unemployment rate was little changed at 5.9 percent. Once again, gains in the leisure and hospitality industry drove much of the expansion as 343,000 new jobs were added in this sector. “The continuing growth in non-farm payroll as reflected in today’s BLS data is also mirrored in the demand for executive, technical, professional, and managerial talent that our Network of over 300 offices saw throughout June. In our most recently reported month, May 2021, our offices successfully completed almost double the search assignments versus the prior May,” said Bert Miller, President and CEO of MRI. “Highest year-over-year growth was in our financial practice, particularly within banking reflecting demand for professionals to manage investment decisions. We also saw significant growth and demand for industrial automation professionals in our manufacturing practices. In addition, we are seeing an uptick in the percentage of face-to-face interviewing as the talent selection process starts to resemble a return to some form of normalcy or now, a new normalcy.” In June, 14.4 percent of the nonfarm workforce reported they teleworked at some point in the past 4 weeks because of the of the pandemic. This was down from 16.6 percent in the prior month indicating continued acceleration in the rate of return to on-site work. “From a market perspective, this was an all-out positive jobs report,” said Seema Shah, chief strategist at Principal Global Investors. “The improvement today likely reflects a slight easing of the labor supply constraints that have been holding back the jobs market in recent months, as well as continued momentum from the economic reopening.” Reporter Josh Mitchell of The Wall Street Journal provided additional context to today’s BLS numbers. He noted Sung Won Sohn, an economist at Western Alliance Bancorporation, said demand is rising as consumers, flush with cash from wage growth and government aid programs, are boosting spending on services they put off last year. But supply—mainly, workers—isn’t keeping up. “Employment gains would be much greater if not for labor shortages,” Mr. Sohn said. Mr. Sohn thinks those shortages will persist beyond this summer, and perhaps in the medium- and long-term and it could take another year or so for the labor market to fully recover from the pandemic. In June, employment in leisure and hospitality increased by 343,000, as pandemic-related restrictions continued to ease in some parts of the country. Over half of the job gain was in food services and drinking places (+194,000). Employment also continued to increase in accommodation (+75,000) and in arts, entertainment, and recreation (+74,000). Employment in professional and business services rose by 72,000 driven primarily by employment in temporary help services (+33,000). Retail trade added 67,000 jobs in June. Over the month, job growth in clothing and clothing accessories stores (+28,000) and general merchandise stores (+25,000) generated most of the gains. Employment gains in most other sectors grew modestly or were little changed versus May. In June, wholesale trade added 21,000 jobs, with gains in both the durable and nondurable goods components. Employment in mining rose by 10,000 in June, reflecting a gain in mining support activities. New positions in manufacturing changed little in June (+15,000). Employment in transportation and warehousing slightly increased in June (+11,000). Also, little changed were jobs in construction that declined by 7,000 versus May. In June, employment showed little change in other major industries, including information, financial activities, and healthcare. “Many clients are focused on bringing talent into their organization who can be transforming and multipliers. Past education and past roles remain important, and candidates who demonstrate and prove their drive toward their ‘intentional north star’ are increasingly in demand. What you do, how you do it, who you positively impact along the way and how you demonstrate a whatever-it-takes mentality is the winning mindset many corporate leaders want to see. Other key attributes are agility, consistency demonstrated during good and bad times, a team-first mentality, open-mindedness and demonstrating leadership regardless of role are some of the intangibles in greatest demand,” noted Miller.

|

Employment Summary for May 2021

The U.S. Bureau of Labor Statistics (BLS) today reported total nonfarm payroll employment increased by 559,000, slightly below analyst expectations but continuing a five month increase in job growth. Unemployment rate declined by 0.3 percentage point to 5.8 percent.

Gains of almost 300,000 jobs in the leisure and hospitality industry drove much of the expansion.

“Our Network offices continue to grow as the U.S. economy expands and our clients’ demand for qualified executive, technical, professional, and managerial talent seems limitless. In our most recently reported month, April 2021, our offices saw almost a doubling of successful search assignments versus the prior April and turned in the strongest overall performance in years,” said Bert Miller, President and CEO of MRI. “Throughout the pandemic our recruitment teams leveraged technology to help clients successfully find and hire great talent through virtual interviews. But it was the promise of a rapid development and roll-out of the U.S. vaccine program, starting as early as October 2020, that supplied clients the added confidence to hire — and candidates the boldness to move from one company to another.”

The BLS reported in May, 16.6 percent of the nonfarm workforce teleworked because of the of the pandemic. This was down from 18.3 percent in the prior month indicating an acceleration in the rate or return to on-site work as the vaccine and relaxed shut-down rules impacted worker behavior.

Economists predict that the labor market won’t fully recover until 2022 despite the current robust demand for workers. “We think it will take several months for frictions in the labor market to work themselves out,” said Michael Gapen, chief U.S. economist at Barclays. “That just means we shouldn’t be expecting one to two million jobs every month. Instead, it will be a more gradual process.”

Providing added detail on what is driving the relatively moderate rate of job recovery, Reuters’ reporter Lucia Mutikani observed, “Government-funded benefits, including a $300 weekly unemployment subsidy, are also constraining hiring. Republican governors in 25 states are terminating this benefit and other unemployment programs funded by the federal government for residents starting next Saturday. These states account for more than 40% of the workforce. The expanded benefits will end in early September across the country. That, together with more people vaccinated and schools fully reopening in the fall, is expected to ease the worker scarcity by September.”

In May, employment in leisure and hospitality increased by 292,000, as pandemic-related restrictions continued to ease in some parts of the country. Nearly two-thirds of the increase was in food services and drinking places (+186,000). Employment also rose in amusements, gambling, and recreation (+58,000) and in accommodation (+35,000).

Healthcare and social assistance added 46,000 jobs in May. Employment in healthcare continued to trend up (+23,000), reflecting a gain in ambulatory healthcare services (+22,000). Social assistance added 23,000 jobs over the month, largely in child day care services (+18,000).

Employment in information rose by 29,000 over the prior month. Reflecting a return to a more normal pattern in the entertainment industry, job gains in May occurred in motion picture and sound recording industries (+14,000).

Manufacturing employment rose by 23,000 in May. A job gain in motor vehicles and parts (+25,000) followed a job loss in April (-38,000).

Transportation and warehousing added 23,000 jobs in May. Employment increased in support activities for transportation (+10,000) and in air transportation (+9,000).

In other key industries, employment in wholesale trade increased by 20,000 in May, mostly in the durable goods. Construction employment edged down in May (-20,000), reflecting a job loss in non-residential specialty trade contractors (-17,000). Employment in professional and business services and retail trade remained relatively flat versus April.

In May, employment changed little in other major industries, including mining, financial activities, and other services.

“When our talent professionals sit down with their C-level clients and ask what’s most important to their company and what’s led to their success, they always say it’s their people. The most astute of these clients never surrendered to a hiring freeze mentality when the downturn began in March 2020. They continued to hire ‘multiplier-capable’ talent to ensure they had the right people in place when the economy would invariably roar back in recovery. Today, clients across the board, in every one of our industry sectors are hiring. Our planning sessions with all of them include the message that the search for top talent transcends virtually any economic downturn,” noted Miller.

|

Employment Summary for April 2021 The U.S. Bureau of Labor Statistics (BLS) today reported total nonfarm payroll employment increased by 266,000, continuing a four month increase in job growth but significantly below consensus estimates. Unemployment rate increased slightly to 6.1 percent, well below its April 2020 high of 14.7 percent. Job growth was led by continued robust expansion in the leisure and hospitality industry. “Our Network of over 300 executive recruitment firms is seeing record breaking demand for top talent across virtually every industry segment. The vast majority of our offices report client demand for transformative talent at levels not seen since the recovery from the Great Recession,” said Bert Miller, President and CEO of MRI. “Our recruiting professionals reported Network-wide year-over-year revenue increases in excess of 40% in March. We are advising our clients to view this continued growth in job demand as much more than a post-Covid recovery. We urge them to look at the talent marketplace through a new lens, where constant technological innovation, ongoing skilled worker shortages, and unprecedented economic growth fueled by infrastructure and capital investment spending are creating a new world of work that requires new talent solutions.” The BLS reported 18.3 percent of all non-farm employed persons teleworked because of the coronavirus pandemic, down from 21.0 percent in March. These data likely reflect an acceleration of workers returning to traditional workplaces as schools re-open for onsite education and the vaccine is more widely available. As noted by Reuters reporter Lucia Mutikani a shortage of workers probably contributed to the muted April results, “U.S. employers hired far few workers than expected in April, likely frustrated by labor shortages, leaving them scrambling to meet booming demand as the economy reopens amid rapidly improving public health and massive financial help from the government. From manufacturing to restaurants, employers are scrambling for workers. A range of factors, including parents still at home caring for children, coronavirus-related retirements, and generous unemployment checks, are blamed for the labor shortages. The moderate pace of hiring could last at least until September when the enhanced unemployment benefits run out.” Echoing those same sentiments, Wall Street Journal reporters Sarah Cambon and Gwynn Guilford note, “Higher vaccination rates, fiscal stimulus and easing business restrictions are converging to support stronger spending across the U.S. But many businesses are reporting they can’t find enough workers, a phenomenon that could restrain economic growth in the coming months. In April, employment in leisure and hospitality increased by 331,000, as pandemic-related restrictions continued to ease in many parts of the country. More than half of the increase was in food services and drinking places (+187,000). Job gains also occurred in amusements, gambling, and recreation (+73,000) and in accommodation (+54,000). Jobs increased by 44,000 in the other services sector and by 31,000 in local government education. Employment in financial activities rose by 19,000 over the month, with most of the gain occurring in real estate and rental and leasing. Manufacturing employment edged down in April (-18,000), following total gains of 89,000 in the previous two months. Employment levels in retail trade, healthcare, construction, and information technology remained virtually unchanged versus the prior month. “The best and brightest candidates are well aware of the demand for top talent. They are looking for roles at firms with clear, compelling, and verifiable hiring brands. They look for a firm’s commitment to true diversity and inclusion, a corporate hiring brand that values not just a candidate’s skills and flexibility but looks at the emotional intelligence and problem-solving skills that transformative talent can bring to an organization. The new world of work is much more than policies on the optimal design of remote work models and other post-Covid temporary fixes. It is about an unrelenting focus on finding and nurturing top talent,” said Miller. |

|

Employment Summary for March 2021 The U.S. Bureau of Labor Statistics (BLS) today reported total nonfarm payroll employment increased by 916,000 in March, significantly above consensus estimates. Unemployment rate fell to 6.0 percent, down considerably from its April 2020 high of 14.7 percent. Job growth was widespread, led by gains in leisure and hospitality, education and construction. “The robust recovery of the U.S. labor market continues as reflected in today’s BLS Employment Situation Report. Our Network of over 300 executive recruitment firms is seeing robust growth driven by our clients’ need for transformative talent in this rapidly improving environment,” said Bert Miller, President and CEO of MRI. “Our recruiting professionals reported double digit year-over-year growth in February, with particular strength in the financial, technology and professional services sectors.” The BLS reported 21.0 percent of all non-farm employed persons teleworked because of the coronavirus pandemic, down from 22.7 percent in February. These data refer to employed persons who teleworked or worked at home for pay at some point in the last four weeks specifically because of the pandemic. Analysts are anticipating continued job growth acceleration in coming months as the confluence of vaccinations, stimulus spending and pent-up consumer demand power the economy. “There’s a seismic shift going on in the U.S. economy,” said Beth Ann Bovino, a Ph.D. economist at S&P Global. “The confluence of additional federal stimulus, growing consumer confidence and the feeling that the pandemic is close to abating—despite rising infections in recent weeks—is propelling economic growth and hiring.” “We were expecting a big number, and today’s jobs report delivered in a major way. It is the flip side of what we saw for March of last year and another clear sign that the U.S. economy is on a strong path to recovery,” said Eric Merlis, head of global markets trading at Citizens Bank. In March, employment in leisure and hospitality increased by 280,000, as pandemic-related restrictions steadily eased in many parts of the country. Nearly two-thirds of the increase was in food services and drinking places (+176,000). Job gains also occurred in arts, entertainment, and recreation (+64,000) and in accommodation (+40,000). In March, employment increased in both public and private education, reflecting the continued resumption of in-person learning and other school-related activities. Total jobs increased by 190,000. Construction added 110,000 jobs in March, following job weather-related losses in the previous month. Employment growth in the industry was widespread in March, with gains of 65,000 in specialty trade contractors, 27,000 in heavy and civil engineering construction, and 18,000 in construction of buildings. Employment in professional and business services rose by 66,000 over the month. In March, employment in administrative and support services continued to trend up (+37,000). Employment also continued an upward trend in management and technical consulting services (+8,000) and in computer systems design and related services (+6,000). Manufacturing industry and the transportation and warehousing sectors saw employment growth of 101,000 in March. Of note, since the pre-pandemic month of February 2020, employment in couriers and messengers is up by 206,000 (or 23.3 percent) as consumers opted for at-home delivery of an expanding list of items. Employment in wholesale trade increased by 24,000 in March, while retail trade added 23,000 jobs. Financial activities added 16,000 jobs in March. Job gains in insurance carriers and related activities (+11,000) and real estate (+10,000) more than offset losses in credit intermediation and related activities. Employment in healthcare and information changed little in March. “The competition for talent is placing demands on clients to ensure their firm is a ‘destination’ for executive, technical, professional and managerial performers who are true multipliers. “A strong employer brand is critical as job growth momentum accelerates in 2021. We counsel our clients to focus on the substantive elements of core brand strength. It is essential to communicate the firm’s values, goals, and culture, while not getting caught up in a flavor-of-the-month competition on issues like work from home policies. “In time, the value of face-to-face collaboration will be recognized as a key component of team success. We urge clients to develop comprehensive flexible workforce solutions incorporating best practices from the virtual environment, learned during the pandemic, into a hybrid setup. Clients now have total talent access solutions available to them as they look to regrow their workforce, including both remote-work models and contract staffing solutions that fit into the new world of work,” noted Miller. |

Employment Summary for February 2021

The U.S. Bureau of Labor Statistics (BLS) today reported total nonfarm payroll employment increased by 379,000 in February, significantly above consensus estimates. Unemployment rate fell 6.2% or 10 million unemployed persons.

Most of the job gains occurred in leisure and hospitality, with smaller gains in temporary help services, healthcare and social assistance, retail trade, and manufacturing.

“We continue to be very encouraged by the recovery of the U.S. labor market as reflected in today’s BLS Employment Situation Report, as well as in the rapid search activity growth we’re seeing in our Network of over 300 executive recruitment offices,” said Bert Miller, President and CEO of MRI. “MRINetwork reported double digit month-over-month growth in January, thanks to major bounce backs across our practices in construction, consumer, healthcare, and more.”

The BLS reported 22.7 percent of employed persons teleworked because of the coronavirus pandemic, down from 23.2 percent in January. These data refer to employed persons who teleworked or worked at home for pay at some point in the last four weeks specifically because of the pandemic.

Analysts are growing more optimistic that hiring will continue to accelerate in coming months.

“The labor force will begin a meaningful recovery in mid-2021 as extensive vaccine distribution will push toward herd immunity, reducing health concerns and allowing for a more complete recovery of some hard-hit industries,” said Ryan Sweet, a senior economist at Moody’s Analytics in West Chester, Pennsylvania.

Reflecting a similar tone, Nela Richardson, a Ph.D. economist at human-resources software firm Automatic Data Processing Inc. noted, “As we reopen the economy, inch-by-inch, that will unleash consumer spending and drive job growth, especially industries that have been most severely affected by the pandemic.”

As reported by the BLS, in February, employment in leisure and hospitality increased by a robust 355,000, as pandemic-related restrictions eased in some parts of the country. About four-fifths of the increase was in food services and drinking places (+286,000). Employment also rose in accommodation (+36,000) and in amusements, gambling, and recreation (+33,000).

Within professional and business services, temporary help services added 53,000 jobs in February.

Employment in healthcare and social assistance increased by 46,000 in February. Healthcare employment increased by 20,000, following a large decline in the prior month (-85,000). In February, job gains in ambulatory healthcare services (+29,000) were partially offset by losses in nursing care facilities (-12,000).

Retail trade added 41,000 jobs in February. Job growth was widespread in the industry, with the largest gains occurring in general merchandise stores (+14,000), health and personal care stores (+12,000), and food and beverage stores (+10,000). These gains were partially offset by a loss in clothing and clothing accessories stores (-20,000). The retail sector has added 2 million jobs from May 2020 through February 2021.

Manufacturing employment increased by 21,000 over the month, led by a gain in transportation equipment (+10,000).

In February, employment changed little in other major industries, including wholesale trade, transportation and warehousing, information, financial activities, and other services.

Employment decreases were noted in local government education (-37,000) and state government education (-32,000).

Severe winter weather across much of the country likely held down employment in construction where jobs fell by 61,000 in February, largely reflecting declines in nonresidential specialty trade contractors (-37,000) and heavy and civil engineering construction (-21,000).

Of note, the change in total nonfarm payroll employment for January was revised up by 117,000, from the previously reported 49,000 increase in January.

“As job growth momentum accelerates in 2021, we are guiding our clients to develop comprehensive flexible workforce solutions that are not simply a “one-size-fits-all” work from home policy. Instead, we recommend that future models incorporate best practices from the virtual environment into a hybrid setup. We do believe that in time the workforce will largely return to in-person collaboration. In the meantime, we are consulting with our clients on the total talent access solutions available to them as they look to regrow their workforce, including contract staffing solutions that fit into an increasingly flexible world of work,” noted Miller. March 2021

Employment Summary for January 2021

Total nonfarm payroll employment improved slightly in January as robust gains in professional and business services were offset somewhat by declines in leisure and hospitality and in retail trade sectors. The January job gain of 49,000 was in-line with most analysts’ expectations and represented an improvement over the weak December Bureau of Labor Statistics (BLS) report. Unemployment rate fell by 0.4 percentage point to 6.3% in January or 10.1 million unemployed persons.

The BLS noted the labor market continued to reflect the impact of the coronavirus pandemic and efforts to contain it. However, the data suggests that the impact of the virus might be lessening; the sharp rate of decline in the large leisure and hospitality sector moderated as government mandated restrictions eased during January.

As noted in the Wall Street Journal today many economists expect the economy could benefit from further government stimulus. Congress is considering as much as $1.9 trillion in additional financial aid to help households and businesses. The proposal would bolster unemployment aid, provide funds for vaccine distribution, and send $1,400 checks to many Americans.

“The resiliency of the U.S. labor market and overall economy is reflected in today’s BLS Employment Situation Report. Our clients’ hiring activity in many sectors of the economy demonstrates that same resiliency as talent consultants from our Network of over 300 executive recruitment offices continue to see solid demand for executive and managerial talent across technical and professional roles,” said Bert Miller, President and CEO of MRI. “But, as demonstrated in today’s BLS data, the job recovery remains uneven in the white-collar roles where much of our Network focuses. I urge political leaders to avoid a ‘government knows best’ solution as they design stimulus programs. It is vital to include input from the people driving private sector hiring that will propel the economy to new heights.”

The BLS reported that in January, 23.2 percent of employed persons teleworked because of the coronavirus pandemic, slightly below December rates. These data refer to employed persons who teleworked or worked at home for pay at some point in the last four weeks specifically due to the pandemic.

In assessing today’s BLS report Dan North, senior economist at Euler Hermes North America saw signs of momentum, ‘it may be a few months before warmer weather, less COVID-19, and more consumer confidence before consumers go on a shopping spree which will provide the real stimulus and job creation.”

As reported by the BLS, in January employment in professional and business services rose by 97,000, with temporary help services accounting for most of the gain (+81,000). Job growth also occurred in management and technical consulting services (+16,000), computer systems design and related services (+11,000), and scientific research and development services (+10,000). These gains were partially offset by job losses in services to buildings and dwellings and in advertising and related services.

Employment increased in local government education (+49,000), state government education (+36,000), and private education (+34,000). The BLS noted that in both public and private education, pandemic-related employment declines in 2020 distorted the normal seasonal buildup and layoff patterns. This likely contributed to the job gains in January.

Wholesale trade continued to add jobs in January (+14,000) as did mining with a gain of 9,000 jobs.

As previously noted, employment in leisure and hospitality declined by 61,000, following a steep decline in December (-536,000). In January, employment edged down in amusements, gambling, and recreation (-27,000) and in accommodation (-18,000). Employment in food services and drinking places was down (-19,000).

Retail trade lost 38,000 jobs in January, after adding 135,000 jobs in December.

Employment in healthcare, transportation and warehousing, manufacturing, and construction changed little versus the prior month as did jobs in other major industries, including information, financial activities, and other services.

“A critical need is to prioritize upskilling talent as today’s businesses deal with fundamental changes to the world of work spurred by digital transition. Our most successful clients are investing in their current workforce to make them better performers today. More importantly, they are anticipating the new skills their existing teams will need to thrive in future.

“That same model should apply to governmental stimulus programs. They should encourage every company to invest capital into upskilling their current workforce while providing added help to the most impacted industries like hospitality, travel, and traditional retail as they adjust to a new world of contactless purchasing, off-premises consumption, and automation that adds new value to the consumer experience. Provide the stimulus to the businesses who are at the front line of transformation and let the recovery accelerate,” noted Miller.

Employment Summary for December 2020

Total nonfarm payroll employment in December declined by 140,000 in December, well below the consensus forecast of a job gain of 45,000. Unemployment rate remained unchanged at 6.7 percent or 10.7 million unemployed persons.

The Bureau of Labor Statistics (BLS) noted in today’s release that both unemployment measures are much lower than their April highs, but still nearly twice their pre-pandemic levels in February (3.5 percent and 5.7 million, respectively). The decline in payroll employment, as reported by the BLS reflects the recent increase in coronavirus (COVID-19) cases and efforts to contain the pandemic. In December, job losses in leisure and hospitality and in private education were partially offset by gains in professional and business services, retail trade, and construction.

“Today’s BLS Employment Situation report reflects the short-term labor market impact of a resurgent virus and the residual political turmoil following the November elections. However, both drivers seem to be in many of our clients’ rear-view mirrors as they assess their need for transformative talent to drive expected growth in the new year,” said Bert Miller, president and CEO of MRI. “Talent consultants from our Network of over 300 executive recruitment offices continue to see solid demand for executive, technical, professional, and managerial roles particularly in building products and special trades; banking, insurance, and financial services; pharmaceutical; and automotive, chemical, and plastics manufacturing.”

The BLS reported that in December, 23.7 percent of employed persons teleworked because of the coronavirus pandemic, up from 21.8 percent in November. These data refer to employed persons who teleworked or worked at home for pay at some point in the last four weeks specifically due to the pandemic. This increasing trend to teleworking is confirmed by MRINetwork recruiters who report many client companies and talented professional workers expect to incorporate some work-from-home days as part of their standard work week schedule as the pandemic eases.

“In some ways, bad news is good news, because it increases the probability for more stimulus,” said Michael Arone, chief investment strategist for US SPDR Business in comments to CNBC. “Investors have convinced themselves this week that given what’s happened in Georgia, given the weakness in the economic data, that more help is on the way. We’re going to get more fiscal help, and it’s likely to happen pretty soon.”

Fox Business reporter Megan Henny noted the key driver of the December data: “The bulk of the losses were concentrated in the hospitality industry, as new restrictions intended to curb the spread of the virus forced bars, restaurants, and hotels to either dramatically scale-back service or close down altogether.”

As reported by the BLS, in December, employment in professional and business services increased by 161,000, with a large gain in temporary help services (+68,000). Job growth also occurred in computer systems design and related services (+20,000), other professional and technical services (+11,000), management of companies and enterprises (+11,000), and business support services (+7,000).

Retail trade added 121,000 jobs in December, with nearly half of the growth occurring in the component of general merchandise stores that includes warehouse clubs and supercenters (+59,000). Job gains also occurred in non-store retailers (+14,000), automobile dealers (+13,000), health and personal care stores (+10,000), and food and beverage stores (+8,000).

Construction added 51,000 jobs in December. Employment rose in residential specialty trade contractors (+14,000) and residential building (+9,000), two industries that have gained back the jobs lost in March and April. In December, employment also increased in nonresidential specialty trade contractors (+18,000) and in heavy and civil engineering construction (+15,000).

Employment in transportation and warehousing rose by 47,000 in December, largely in couriers and messengers (+37,000). Employment in couriers and messengers has increased by 222,000 since February. In December, employment also grew in warehousing and storage (+8,000) and in truck transportation (+7,000), while transit and ground passenger transportation lost 9,000 jobs.

In December, healthcare added 39,000 jobs. Employment growth in hospitals (+32,000) and ambulatory healthcare services (+21,000) was partially offset by declines in nursing care facilities (-6,000) and community care facilities for the elderly (-5,000).